Understanding Your AutoZone Paystubs: A Comprehensive Guide

Navigating the complexities of payroll can often feel like deciphering a foreign language. For AutoZone employees, understanding your AutoZone paystubs is crucial for managing your finances and ensuring accurate compensation. This guide aims to provide a comprehensive overview of how to read and interpret your AutoZone paystubs, empowering you to take control of your earnings and deductions.

Why Understanding Your Paystub Matters

Your AutoZone paystubs aren’t just receipts; they’re detailed records of your earnings, taxes, and benefits. Understanding them allows you to:

- Verify Accuracy: Ensure you’re being paid the correct hourly rate, overtime, and any applicable bonuses.

- Track Deductions: Monitor your tax withholdings, insurance premiums, and retirement contributions.

- Budget Effectively: Plan your finances based on your net pay and understand where your money is going.

- Resolve Discrepancies: Identify and address any errors in your pay before they become significant problems.

- Prepare for Taxes: Use your paystubs to accurately file your tax return.

Accessing Your AutoZone Paystubs

AutoZone typically provides employees with access to their paystubs electronically through an online portal. Here’s how you can generally access them:

- Employee Self-Service Portal: AutoZone likely uses a dedicated employee portal where you can view your paystubs, update your personal information, and access other HR-related documents.

- Login Credentials: You’ll need your employee ID and password to log in. If you’ve forgotten your credentials, follow the portal’s instructions for password recovery or contact your HR department.

- Navigation: Once logged in, navigate to the “Paystubs,” “Payroll,” or similar section.

- Viewing and Downloading: You should be able to view your paystubs online and download them as PDF files for your records.

If you’re having trouble accessing your AutoZone paystubs online, contact your HR department or payroll administrator for assistance.

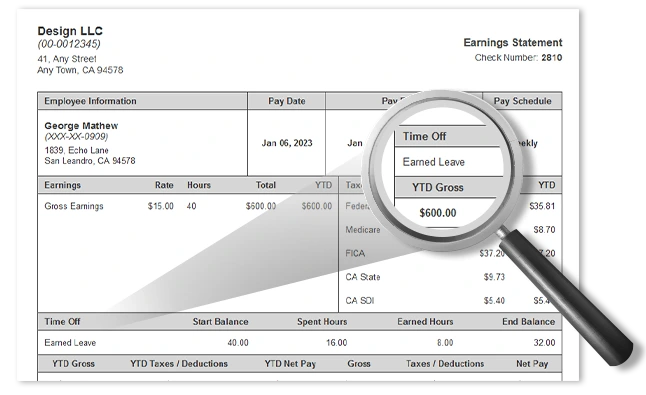

Decoding Your AutoZone Paystub: Key Sections

An AutoZone paystub typically includes several key sections. Let’s break down each one:

Employee Information

This section contains your basic information, including:

- Your full name

- Your employee ID

- Your address

- The pay period (the dates covered by the paystub)

Earnings

This section details your gross earnings for the pay period. It includes:

- Regular Pay: Your hourly rate multiplied by the number of regular hours worked.

- Overtime Pay: Your overtime rate (typically 1.5 times your regular rate) multiplied by the number of overtime hours worked.

- Bonuses: Any bonuses you’ve earned during the pay period.

- Other Earnings: This could include things like vacation pay, sick pay, or holiday pay.

Taxes

This section shows the taxes that have been withheld from your paycheck. Common taxes include:

- Federal Income Tax: Withheld based on your W-4 form (Employee’s Withholding Certificate).

- State Income Tax: Withheld based on your state’s tax laws and your state withholding form.

- Social Security Tax: 6.2% of your gross earnings (up to a certain limit).

- Medicare Tax: 1.45% of your gross earnings.

Deductions

This section lists all the deductions taken from your paycheck, other than taxes. Common deductions include:

- Health Insurance Premiums: The amount you pay for your health insurance coverage.

- Dental Insurance Premiums: The amount you pay for your dental insurance coverage.

- Vision Insurance Premiums: The amount you pay for your vision insurance coverage.

- Retirement Contributions: Contributions to your 401(k) or other retirement plan.

- Other Deductions: This could include things like union dues, charitable contributions, or loan repayments.

Employer Contributions

This section shows the contributions your employer makes on your behalf. Common employer contributions include:

- Social Security and Medicare Taxes: AutoZone also pays a portion of these taxes.

- Retirement Contributions: AutoZone may match a portion of your retirement contributions.

- Health Insurance Contributions: AutoZone contributes to your health insurance premiums.

Net Pay

This is the amount of money you actually receive after all taxes and deductions have been taken out. It’s calculated as:

Gross Earnings – Taxes – Deductions = Net Pay

Year-to-Date (YTD) Totals

This section shows the cumulative amounts for your earnings, taxes, and deductions for the entire year. This information is useful for tax preparation.

Common Abbreviations and Terms on Your AutoZone Paystub

AutoZone paystubs may contain abbreviations and terms that you’re not familiar with. Here are some common ones:

- REG: Regular Pay

- OT: Overtime Pay

- FIT: Federal Income Tax

- SIT: State Income Tax

- FICA: Federal Insurance Contributions Act (Social Security and Medicare)

- MED: Medicare Tax

- 401K: 401(k) Retirement Plan

- YTD: Year-to-Date

- GTL: Group Term Life Insurance

- STD: Short-Term Disability

- LTD: Long-Term Disability

If you’re unsure about the meaning of any abbreviation or term, contact your HR department for clarification.

Troubleshooting Paystub Issues

If you notice any errors or discrepancies on your AutoZone paystubs, it’s important to address them promptly. Here are some steps you can take:

- Review Your Paystub Carefully: Double-check all the information, including your hourly rate, hours worked, and deductions.

- Compare to Your Time Records: Compare your paystub to your time records to ensure that your hours were accurately recorded.

- Contact Your Supervisor or HR Department: If you find any errors, contact your supervisor or HR department immediately to report the issue.

- Document Everything: Keep a record of all communication with your supervisor or HR department, including dates, times, and the names of the people you spoke with.

- Follow Up: If you don’t receive a response within a reasonable timeframe, follow up with your supervisor or HR department.

Addressing paystub issues promptly can prevent them from escalating and ensure that you’re being paid correctly.

Tips for Managing Your Paystubs

Here are some tips for effectively managing your AutoZone paystubs:

- Save Your Paystubs: Keep copies of your paystubs for at least one year, or longer if you need them for tax purposes or other financial planning.

- Organize Your Paystubs: Organize your paystubs in a way that makes them easy to find, such as by date or pay period.

- Consider Digital Storage: Scan your paystubs and store them electronically for easy access and backup.

- Review Your Paystubs Regularly: Take the time to review your paystubs each pay period to ensure accuracy and identify any potential issues.

By following these tips, you can stay organized and informed about your earnings and deductions.

The Importance of Accurate Record-Keeping

Maintaining accurate records of your AutoZone paystubs is crucial for several reasons:

- Tax Preparation: Your paystubs provide the information you need to accurately file your tax return.

- Loan Applications: Lenders may require paystubs as proof of income when you apply for a loan.

- Government Benefits: Government agencies may require paystubs to verify your income when you apply for benefits.

- Financial Planning: Your paystubs can help you track your income and expenses, which is essential for financial planning.

By keeping your paystubs organized and accessible, you’ll be prepared for any situation that requires proof of income.

Conclusion

Understanding your AutoZone paystubs is an essential part of managing your finances as an employee. By taking the time to learn how to read and interpret your paystubs, you can ensure that you’re being paid correctly, track your deductions, and plan your finances effectively. If you have any questions or concerns about your paystubs, don’t hesitate to contact your supervisor or HR department for assistance. Remember to always keep your AutoZone paystubs safe and organized for future reference. This guide should serve as a helpful resource in navigating the intricacies of your AutoZone paystubs and empowering you to take control of your financial well-being. Proper understanding of your AutoZone paystubs will also help when filing taxes and understanding your financial standing with the company. Keep in mind that your AutoZone paystubs are important legal documents. Finally, always ensure your AutoZone paystubs information is accurate and up-to-date. [See also: AutoZone Employee Benefits Package] and [See also: How to Apply for a Job at AutoZone]