Decoding the Apple Business Statement: A Comprehensive Guide

The Apple Business Statement serves as a crucial financial document for Apple Inc., offering insights into the company’s performance, strategic direction, and overall financial health. Understanding this statement is essential for investors, analysts, and anyone interested in the inner workings of one of the world’s most valuable companies. This article provides a comprehensive overview of the Apple Business Statement, breaking down its key components and explaining how to interpret the data presented.

Understanding the Basics of the Apple Business Statement

An Apple Business Statement, like any corporate financial report, is designed to present a clear picture of the company’s financial activities over a specific period, typically a quarter or a fiscal year. It’s more than just numbers; it’s a narrative of Apple’s business operations, successes, and challenges.

Key Components of the Statement

The Apple Business Statement typically includes the following main sections:

- Income Statement (Profit and Loss Statement): This shows revenues, expenses, and profits over a period.

- Balance Sheet: A snapshot of Apple’s assets, liabilities, and equity at a specific point in time.

- Statement of Cash Flows: Tracks the movement of cash both into and out of the company.

- Statement of Stockholders’ Equity: Details changes in shareholders’ equity over time.

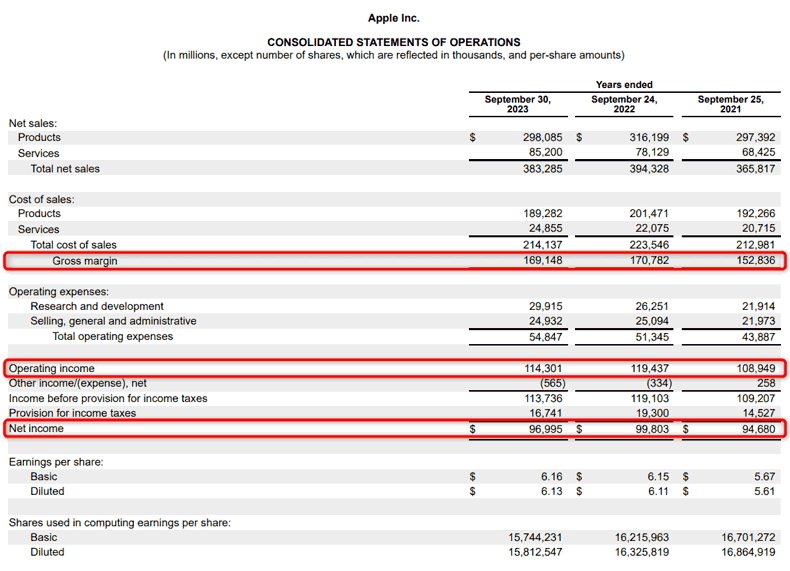

Analyzing the Income Statement

The income statement, sometimes called the profit and loss (P&L) statement, is arguably the most watched section of the Apple Business Statement. It provides a detailed look at how Apple generates revenue and manages its expenses.

Revenue Breakdown

Apple’s revenue is typically broken down by product category (iPhone, Mac, iPad, Wearables, Home and Accessories, Services) and geographic region. Analyzing these segments can reveal important trends. For example, a decline in iPhone sales in China might signal broader economic challenges or increased competition.

Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing and selling Apple’s products. Monitoring COGS can help assess Apple’s manufacturing efficiency and supply chain management. Increases in COGS as a percentage of revenue could indicate rising component costs or manufacturing inefficiencies.

Operating Expenses

Operating expenses include research and development (R&D), selling, general, and administrative (SG&A) costs. R&D spending is particularly important for a technology company like Apple, as it reflects investment in future products and innovations. SG&A expenses cover the costs of running the business, such as marketing, sales, and administrative salaries.

Net Income

Net income is the bottom line – the profit Apple earns after all expenses are deducted. It’s a key indicator of profitability and is often used to calculate earnings per share (EPS), a widely followed metric by investors.

Deciphering the Balance Sheet

The balance sheet provides a snapshot of Apple’s financial position at a specific point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity.

Assets

Assets are what Apple owns. They are divided into current assets (cash, marketable securities, accounts receivable, inventory) and non-current assets (property, plant, and equipment (PP&E), intangible assets). Apple typically holds a large amount of cash and marketable securities, reflecting its strong financial position. High levels of inventory could suggest potential issues with demand or supply chain management.

Liabilities

Liabilities are what Apple owes to others. They include current liabilities (accounts payable, short-term debt) and non-current liabilities (long-term debt, deferred revenue). Apple’s debt levels are often scrutinized, as the company has strategically used debt financing to fund share buybacks and dividends.

Equity

Equity represents the owners’ stake in the company. It includes common stock, retained earnings, and accumulated other comprehensive income. Changes in equity reflect the company’s profitability, dividend payments, and stock issuances or repurchases.

Analyzing the Statement of Cash Flows

The statement of cash flows tracks the movement of cash both into and out of Apple. It’s divided into three main sections: operating activities, investing activities, and financing activities.

Cash Flow from Operating Activities

This section reflects cash generated from Apple’s core business operations. It starts with net income and adjusts for non-cash items such as depreciation and amortization. Positive cash flow from operations indicates that Apple is generating sufficient cash to fund its business.

Cash Flow from Investing Activities

This section includes cash flows related to the purchase and sale of long-term assets, such as PP&E and investments. Significant investments in PP&E could signal expansion plans or upgrades to manufacturing facilities.

Cash Flow from Financing Activities

This section includes cash flows related to debt, equity, and dividends. It shows how Apple raises capital and returns cash to shareholders through dividends and share repurchases. Large share buybacks can boost earnings per share but also reduce the company’s cash reserves.

Statement of Stockholders’ Equity

This statement reconciles the changes in the equity accounts from the beginning to the end of the accounting period. It details the impacts of net income, dividends, stock issuances, and share repurchases on the shareholders’ equity. This statement is essential for understanding how Apple manages its equity structure and returns value to its shareholders. Any significant changes in this statement can provide insights into Apple’s capital allocation strategies and its commitment to rewarding investors.

Interpreting the Apple Business Statement: Key Ratios and Metrics

Beyond the individual statements, several key ratios and metrics can be derived from the Apple Business Statement to provide deeper insights into the company’s performance.

Profitability Ratios

- Gross Profit Margin: (Revenue – COGS) / Revenue. Measures the percentage of revenue remaining after deducting the cost of goods sold.

- Operating Margin: Operating Income / Revenue. Measures the percentage of revenue remaining after deducting operating expenses.

- Net Profit Margin: Net Income / Revenue. Measures the percentage of revenue remaining after deducting all expenses.

Liquidity Ratios

- Current Ratio: Current Assets / Current Liabilities. Measures Apple’s ability to meet its short-term obligations.

- Quick Ratio: (Current Assets – Inventory) / Current Liabilities. A more conservative measure of liquidity that excludes inventory.

Solvency Ratios

- Debt-to-Equity Ratio: Total Debt / Total Equity. Measures the proportion of debt used to finance Apple’s assets relative to equity.

Efficiency Ratios

- Asset Turnover Ratio: Revenue / Total Assets. Measures how efficiently Apple is using its assets to generate revenue.

- Inventory Turnover Ratio: COGS / Average Inventory. Measures how quickly Apple is selling its inventory.

The Importance of Footnotes

The footnotes to the Apple Business Statement are crucial for understanding the underlying assumptions, accounting policies, and contingent liabilities. These notes provide additional details and explanations that are not readily apparent in the main financial statements. Investors and analysts should carefully review the footnotes to gain a comprehensive understanding of Apple’s financial position and performance.

Recent Trends and Insights from Apple’s Business Statements

Analyzing recent Apple Business Statements reveals several key trends and insights. For example, the increasing importance of the Services segment (Apple Music, iCloud, Apple Pay) highlights Apple’s diversification efforts beyond hardware. The company’s focus on share buybacks and dividends demonstrates its commitment to returning value to shareholders. Also, the impact of global economic conditions and supply chain disruptions are often reflected in the statements. [See also: Apple’s Stock Performance Analysis]

The Role of the Apple Business Statement in Investment Decisions

The Apple Business Statement is a vital tool for investors making decisions about buying, selling, or holding Apple stock. By carefully analyzing the financial statements and related disclosures, investors can assess Apple’s financial health, growth prospects, and risk profile. A thorough understanding of the Apple Business Statement can help investors make informed decisions and avoid potential pitfalls.

Conclusion: Mastering the Apple Business Statement

The Apple Business Statement is a complex but essential document for understanding the financial performance and strategic direction of Apple Inc. By mastering the key components, ratios, and metrics discussed in this article, investors, analysts, and anyone interested in Apple can gain valuable insights into one of the world’s most successful companies. Understanding the Apple Business Statement is not just about crunching numbers; it’s about understanding the story behind the numbers and the future trajectory of this tech giant. Reviewing the Apple Business Statement and understanding the nuances is critical for making sound judgments about the company’s future and potential challenges. Consistent analysis of the Apple Business Statement is crucial for staying informed about changes in Apple’s financial strategy. The Apple Business Statement provides valuable insight into how Apple manages cash flow and investments. The Apple Business Statement clearly outlines the company’s revenue streams and cost management. The Apple Business Statement also highlights areas of growth and potential risk. It’s important to carefully examine each Apple Business Statement release for any significant changes. The Apple Business Statement can also reveal the impact of new product launches on Apple’s finances. Investors should always carefully consider the Apple Business Statement when making investment decisions. The Apple Business Statement provides a transparent view of Apple’s financial activities. The Apple Business Statement is a valuable tool for assessing the overall health of the company.